2023 was a calm and stable year for the Indian rupee. The domestic currency was stuck in a narrow range of 80.88 to 83.45 all through the year. Interest rate hikes in the US, strong rise in US Treasury yields, geopolitical tensions, banking crisis — all these were supposed to have knocked down the rupee badly last year. But that did not happen. Thanks to the Reserve Bank of India (RBI) being on both sides (buy and sell) of the market.

What’s going to happen, going forward? Here, we look at the factors that can impact the rupee movement in 2024

Interest rate cuts

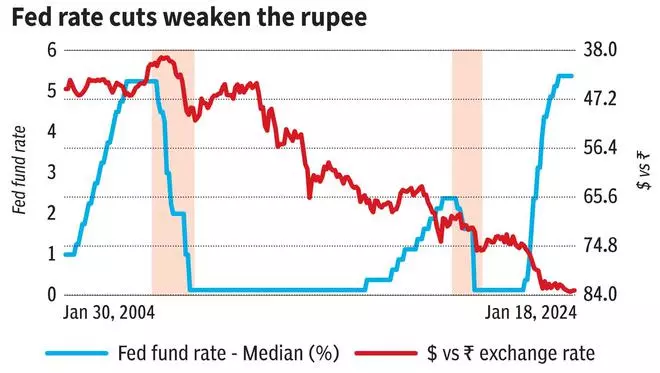

The US Federal Reserve’s latest Dot Plot has indicated a 75-basis points (bps) rate cut this year. The central bank’s economic projections released in December last year showed that the Fed’s median fund rate would be at 4.6 per cent in 2024, down from 5.4 per cent in 2023. So, there could be three rate cuts of 25-bps each coming up this year.

It is important to see as what is going to be the trigger for this rate cuts. If the rate cuts happen on the back of cooling inflation, then that would have a smooth transition in the market. In that case, the US dollar can weaken, and the Treasury yields can fall. This will be positive for the rupee.

But if the rate cut happens because of some unexpected events, then that could shake the market. Historical study on Fed fund rates indicates that interest rate peaks in the past have always been followed by a recession in the US. For instance, the interest rates in the US peaked at 6.5 per cent in 2000 and 5.25 per cent in 2007. These were followed by the dotcom bust in 2001 and the global financial crisis in 2008-2009. So, if history repeats and the rate cuts happen because of a recession in the US or a crisis in any form, then the market would turn highly risk-averse. That will be negative for the rupee.

As seen from the chart alongside, in the earlier instances, since the rate cuts were triggered by some crisis, the rupee weakened. If the same happens, then the rupee can weaken towards 84-85 this year, in the absence of any significant RBI intervention in the market.

Geopolitical situation

The Israel-Hamas war that broke out in 2023 has largely been absorbed well by the market so far. The drone strike by Iran on Pakistan last week adds to the list of global geopolitical tensions.

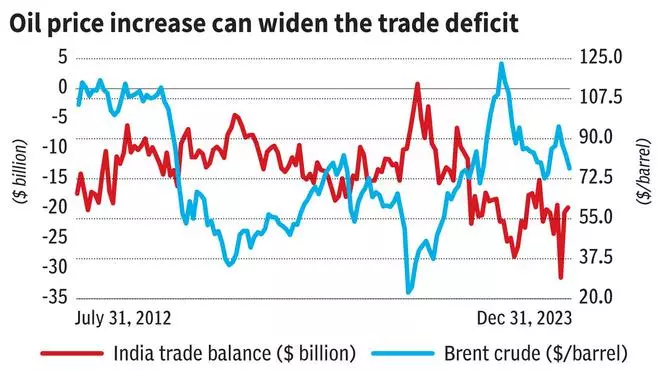

The recent attacks on cargo ships in the Red Sea are a fresh concern for global trade. If this condition prolongs, then that can increase the import cost. Although there is no danger of any supply disruption as of now, there could be a significant delay in goods delivery. There is a risk of import cost going up. India being a more import-dependent country for key raw materials such as crude, this could weigh on the trade balance, going forward.

Another important development that will need a close watch in 2024 will be that between Taiwan and China. Taiwan is not in favour of the unification with China. It will have to be seen whether the newly elected Taiwan President intensifies this issue or not.

All these geopolitical developments keep the danger ofcrude oil prices going up alive, if there is an escalation. Brent Crude prices coming down from a high of around $94 per barrel to a low of $73 in the last quarter of 2023 has helped ease India’s trade deficit. The deficit has narrowed from $31.46 billion in October to $19.80 billion in December. In case the geopolitical tensions escalate, and the oil prices move above $95-$100, then that could widen India’s trade deficit. That will be negative for the rupee.

Bond inclusion

India’s inclusion in the JP Morgan’s global bond market index has been considered as a big positive for the rupee as more foreign money inflows are expected. India’s weightage in the index is expected to reach 10 per cent by March next year. Market expects a cumulative inflow of about $25 billion once the inclusion happens by the end of June this year.

However, the reality might be different. Foreign money inflows in Indian bonds will depend on many other external factors. Also, it is not mandatory for the global funds to invest in Indian bonds after its inclusion. They may or may not choose to do so. So, if bullish inflows on the back of this bond inclusion do not happen, then rupee might come under pressure in the second half of this year. We will have to wait and watch to see the reality.

Slowdown woes

The global economy is projected to slow down in 2024. The International Monetary Fund (IMF) has forecast growth slowing down to 2.9 per cent this year from 3 per cent in 2023.

The US Federal Reserve has estimated US GDP growth to decelerate sharply, in its forecast released in December. The Fed expects the US to grow by just 1.4 per cent this year, down from growth estimates of 2.6 per cent in 2023.

So, broadly, global economic slowdown is expected this year. That might cap the strength in the rupee and keep it weak. The momentum of slowdown and the trigger for that is going to be very important in determining the quantum of weakness for the rupee.

Election year

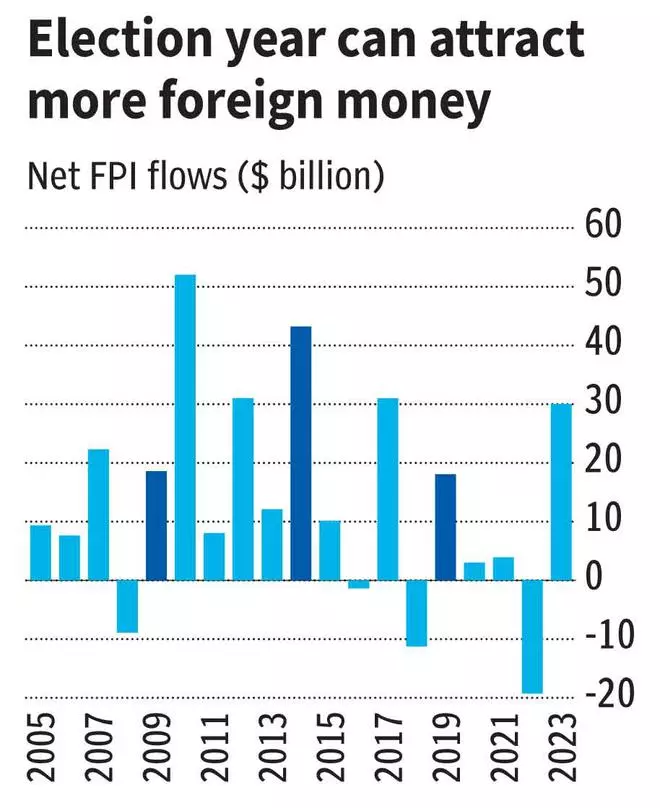

In India, outcome of the State elections in December has increased hopes that the ruling Bharatiya Janata Party (BJP) will retain power in the elections to be held this year.

Foreign money flows into the country have got a boost after the December State election results. Foreign Portfolio Investors (FPIs) have poured in over $10 billion (equity plus debt) in the month of December.

Data indicates that election years have seen strong FPI inflows. Since 2009, the equity segment had seen an average net inflow of about $15 billion in three election years. The debt segment saw an average inflow of about $19 billion in 2009 and 2019. The year 2014 was an exception wherein the debt segment attracted a huge inflow of about $27 billion on the back of high interest rates and a new government formation. The Reserve Bank of Indiaincreased the repo rates from 7.25 per cent in September 2013 to 8 per cent in 2014 and left it unchanged thereafter all through 2014.

If this trend of strong inflows in the election year continues, then that could limit the scope for weakness in the rupee and aid the domestic currency to strengthen. Any surprise in the election outcome this year might cause volatility, but that would be short-lived.

However, the rupee movement will depend on other factors also. The US and Russia are the other major economies that will witness elections this year. Those can impact the dollar movement which, in turn, can affect the rupee accordingly.

RBI the decider

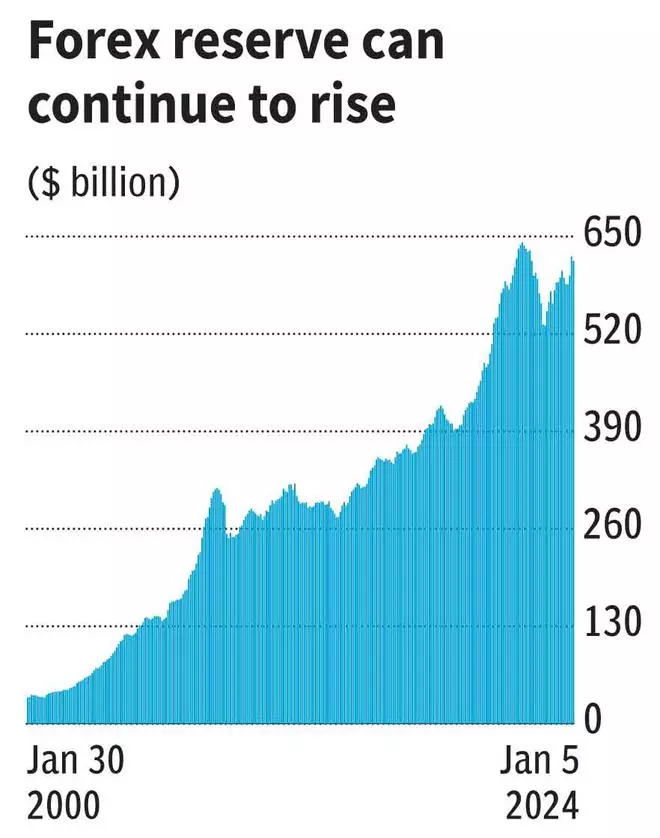

Finally, everything narrows down to what the RBI is going to do this year. All through 2023, the central bank had intervened in the forex market and contained the movement on both sides. Forex Reserves have increased from $562.85 billion in 2022 to $623.2 billion by the end of 2023. The central bank intervention in the forex market is likely to continue this year also. While the RBI might be aiming to take the reserves up to the previous high of $640 billion touched in 2021, the chances are high for the central bank to take the reserves well beyond the previous high if it continues with its current stance.

So, as such, we may not expect the rupee to appreciate much considering the scope for intervention of the central bank in the market. On the other hand, if the volatility increases due to any external factors and the rupee starts to fall, the RBI may aid in controlling the pace of the fall in the domestic currency.

To sum up

Considering all the above factors, we see the foreign money inflows into the country to be the only major factor that is in favour of the rupee. Given the uncertainty prevailing due to geopolitical tensions, prospects for a global slowdown, RBI’s intervention in the market, the chances for the rupee to see a strong appreciation in 2024 appear bleak. The reason — whether it is a soft landing or any crisis — that makes the Fed start to cut rates this year will need a close watch.

Looking at the history, the RBI had intervened more to arrest the rupee from appreciationg strongly. When it comes to depreciation, the central bank woild allow it to weaken but can contain the pace of weakness.

So, much appreciation in the rupee is not anticipated. Broadly, we can expect the rupee to remain in a range of 82-83.50 (narrow) or 81.50-86 (broad) this year.

What the charts say

On the charts, strong resistance for the rupee are at 82.50, 81.80 and 81.50. So, for the rupee to break and strengthen above 81.50 or even 81.80, it would need a very strong trigger. If that break happens, then the rupee can strengthen to 80 or 79.50. But such a move looks unlikely considering the price action on the charts.

So, we see high chances for the rupee to remain below 81.80 this year. Key support is in the 83.50-83.60 region. A below 83.60 will see the rupee falling towards 85.70 this year. In the worst-case scenario, there is also a danger of seeing 87 on the downside. But considering the presence of RBI in the market, we would expect the downside to be limited to 85.70 this year

A recovery from around 85.70 can take the rupee up again towards 83.50.